Error message

Warning: unserialize(): Error at offset 0 of 285 bytes in Drupal\hg_features\Controller\APIController->export() (line 527 of modules/custom/hg_features/src/Controller/APIController.php).

Drupal\hg_features\Controller\APIController->export() (Line: 249) Drupal\hg_features\Controller\ContentAPIController->export() (Line: 461) Drupal\hg_features\Controller\NodeAPIController->export() (Line: 916) Drupal\hg_features\Controller\NodeAPIController->list() (Line: 450) Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock->__construct() (Line: 718) Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock::create() (Line: 21) Drupal\Core\Plugin\Factory\ContainerFactory->createInstance() (Line: 76) Drupal\Component\Plugin\PluginManagerBase->createInstance() (Line: 62) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->initializePlugin() (Line: 57) Drupal\block\BlockPluginCollection->initializePlugin() (Line: 80) Drupal\Component\Plugin\LazyPluginCollection->get() (Line: 45) Drupal\block\BlockPluginCollection->get() (Line: 88) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->setConfiguration() (Line: 104) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->addInstanceId() (Line: 55) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->__construct() (Line: 34) Drupal\block\BlockPluginCollection->__construct() (Line: 158) Drupal\block\Entity\Block->getPluginCollection() (Line: 147) Drupal\block\Entity\Block->getPlugin() (Line: 118) Drupal\block\BlockAccessControlHandler->checkAccess() (Line: 109) Drupal\Core\Entity\EntityAccessControlHandler->access() (Line: 329) Drupal\Core\Entity\EntityBase->access() (Line: 63) Drupal\block\BlockRepository->getVisibleBlocksPerRegion() (Line: 138) Drupal\block\Plugin\DisplayVariant\BlockPageVariant->build() (Line: 270) Drupal\Core\Render\MainContent\HtmlRenderer->prepare() (Line: 128) Drupal\Core\Render\MainContent\HtmlRenderer->renderResponse() (Line: 90) Drupal\Core\EventSubscriber\MainContentViewSubscriber->onViewRenderArray() call_user_func() (Line: 111) Drupal\Component\EventDispatcher\ContainerAwareEventDispatcher->dispatch() (Line: 186) Symfony\Component\HttpKernel\HttpKernel->handleRaw() (Line: 76) Symfony\Component\HttpKernel\HttpKernel->handle() (Line: 53) Drupal\Core\StackMiddleware\Session->handle() (Line: 48) Drupal\Core\StackMiddleware\KernelPreHandle->handle() (Line: 28) Drupal\Core\StackMiddleware\ContentLength->handle() (Line: 201) Drupal\page_cache\StackMiddleware\PageCache->fetch() (Line: 138) Drupal\page_cache\StackMiddleware\PageCache->lookup() (Line: 87) Drupal\page_cache\StackMiddleware\PageCache->handle() (Line: 48) Drupal\Core\StackMiddleware\ReverseProxyMiddleware->handle() (Line: 51) Drupal\Core\StackMiddleware\NegotiationMiddleware->handle() (Line: 36) Drupal\Core\StackMiddleware\AjaxPageState->handle() (Line: 51) Drupal\Core\StackMiddleware\StackedHttpKernel->handle() (Line: 741) Drupal\Core\DrupalKernel->handle() (Line: 19)

Warning: unserialize(): Error at offset 0 of 378 bytes in Drupal\hg_features\Controller\APIController->export() (line 527 of modules/custom/hg_features/src/Controller/APIController.php).

Drupal\hg_features\Controller\APIController->export() (Line: 249) Drupal\hg_features\Controller\ContentAPIController->export() (Line: 461) Drupal\hg_features\Controller\NodeAPIController->export() (Line: 916) Drupal\hg_features\Controller\NodeAPIController->list() (Line: 450) Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock->__construct() (Line: 718) Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock::create() (Line: 21) Drupal\Core\Plugin\Factory\ContainerFactory->createInstance() (Line: 76) Drupal\Component\Plugin\PluginManagerBase->createInstance() (Line: 62) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->initializePlugin() (Line: 57) Drupal\block\BlockPluginCollection->initializePlugin() (Line: 80) Drupal\Component\Plugin\LazyPluginCollection->get() (Line: 45) Drupal\block\BlockPluginCollection->get() (Line: 88) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->setConfiguration() (Line: 104) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->addInstanceId() (Line: 55) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->__construct() (Line: 34) Drupal\block\BlockPluginCollection->__construct() (Line: 158) Drupal\block\Entity\Block->getPluginCollection() (Line: 147) Drupal\block\Entity\Block->getPlugin() (Line: 118) Drupal\block\BlockAccessControlHandler->checkAccess() (Line: 109) Drupal\Core\Entity\EntityAccessControlHandler->access() (Line: 329) Drupal\Core\Entity\EntityBase->access() (Line: 63) Drupal\block\BlockRepository->getVisibleBlocksPerRegion() (Line: 138) Drupal\block\Plugin\DisplayVariant\BlockPageVariant->build() (Line: 270) Drupal\Core\Render\MainContent\HtmlRenderer->prepare() (Line: 128) Drupal\Core\Render\MainContent\HtmlRenderer->renderResponse() (Line: 90) Drupal\Core\EventSubscriber\MainContentViewSubscriber->onViewRenderArray() call_user_func() (Line: 111) Drupal\Component\EventDispatcher\ContainerAwareEventDispatcher->dispatch() (Line: 186) Symfony\Component\HttpKernel\HttpKernel->handleRaw() (Line: 76) Symfony\Component\HttpKernel\HttpKernel->handle() (Line: 53) Drupal\Core\StackMiddleware\Session->handle() (Line: 48) Drupal\Core\StackMiddleware\KernelPreHandle->handle() (Line: 28) Drupal\Core\StackMiddleware\ContentLength->handle() (Line: 201) Drupal\page_cache\StackMiddleware\PageCache->fetch() (Line: 138) Drupal\page_cache\StackMiddleware\PageCache->lookup() (Line: 87) Drupal\page_cache\StackMiddleware\PageCache->handle() (Line: 48) Drupal\Core\StackMiddleware\ReverseProxyMiddleware->handle() (Line: 51) Drupal\Core\StackMiddleware\NegotiationMiddleware->handle() (Line: 36) Drupal\Core\StackMiddleware\AjaxPageState->handle() (Line: 51) Drupal\Core\StackMiddleware\StackedHttpKernel->handle() (Line: 741) Drupal\Core\DrupalKernel->handle() (Line: 19)

Warning: unserialize(): Error at offset 0 of 62 bytes in Drupal\hg_features\Controller\APIController->export() (line 527 of modules/custom/hg_features/src/Controller/APIController.php).

Drupal\hg_features\Controller\APIController->export() (Line: 249) Drupal\hg_features\Controller\ContentAPIController->export() (Line: 461) Drupal\hg_features\Controller\NodeAPIController->export() (Line: 403) Drupal\hg_features\Controller\APIController->export() (Line: 249) Drupal\hg_features\Controller\ContentAPIController->export() (Line: 461) Drupal\hg_features\Controller\NodeAPIController->export() (Line: 422) Drupal\hg_features\Controller\APIController->export() (Line: 249) Drupal\hg_features\Controller\ContentAPIController->export() (Line: 461) Drupal\hg_features\Controller\NodeAPIController->export() (Line: 916) Drupal\hg_features\Controller\NodeAPIController->list() (Line: 450) Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock->__construct() (Line: 718) Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock::create() (Line: 21) Drupal\Core\Plugin\Factory\ContainerFactory->createInstance() (Line: 76) Drupal\Component\Plugin\PluginManagerBase->createInstance() (Line: 62) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->initializePlugin() (Line: 57) Drupal\block\BlockPluginCollection->initializePlugin() (Line: 80) Drupal\Component\Plugin\LazyPluginCollection->get() (Line: 45) Drupal\block\BlockPluginCollection->get() (Line: 88) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->setConfiguration() (Line: 104) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->addInstanceId() (Line: 55) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->__construct() (Line: 34) Drupal\block\BlockPluginCollection->__construct() (Line: 158) Drupal\block\Entity\Block->getPluginCollection() (Line: 147) Drupal\block\Entity\Block->getPlugin() (Line: 118) Drupal\block\BlockAccessControlHandler->checkAccess() (Line: 109) Drupal\Core\Entity\EntityAccessControlHandler->access() (Line: 329) Drupal\Core\Entity\EntityBase->access() (Line: 63) Drupal\block\BlockRepository->getVisibleBlocksPerRegion() (Line: 138) Drupal\block\Plugin\DisplayVariant\BlockPageVariant->build() (Line: 270) Drupal\Core\Render\MainContent\HtmlRenderer->prepare() (Line: 128) Drupal\Core\Render\MainContent\HtmlRenderer->renderResponse() (Line: 90) Drupal\Core\EventSubscriber\MainContentViewSubscriber->onViewRenderArray() call_user_func() (Line: 111) Drupal\Component\EventDispatcher\ContainerAwareEventDispatcher->dispatch() (Line: 186) Symfony\Component\HttpKernel\HttpKernel->handleRaw() (Line: 76) Symfony\Component\HttpKernel\HttpKernel->handle() (Line: 53) Drupal\Core\StackMiddleware\Session->handle() (Line: 48) Drupal\Core\StackMiddleware\KernelPreHandle->handle() (Line: 28) Drupal\Core\StackMiddleware\ContentLength->handle() (Line: 201) Drupal\page_cache\StackMiddleware\PageCache->fetch() (Line: 138) Drupal\page_cache\StackMiddleware\PageCache->lookup() (Line: 87) Drupal\page_cache\StackMiddleware\PageCache->handle() (Line: 48) Drupal\Core\StackMiddleware\ReverseProxyMiddleware->handle() (Line: 51) Drupal\Core\StackMiddleware\NegotiationMiddleware->handle() (Line: 36) Drupal\Core\StackMiddleware\AjaxPageState->handle() (Line: 51) Drupal\Core\StackMiddleware\StackedHttpKernel->handle() (Line: 741) Drupal\Core\DrupalKernel->handle() (Line: 19)

Warning: unserialize(): Error at offset 0 of 62 bytes in Drupal\hg_features\Controller\APIController->export() (line 527 of modules/custom/hg_features/src/Controller/APIController.php).

Drupal\hg_features\Controller\APIController->export() (Line: 249) Drupal\hg_features\Controller\ContentAPIController->export() (Line: 461) Drupal\hg_features\Controller\NodeAPIController->export() (Line: 403) Drupal\hg_features\Controller\APIController->export() (Line: 249) Drupal\hg_features\Controller\ContentAPIController->export() (Line: 461) Drupal\hg_features\Controller\NodeAPIController->export() (Line: 916) Drupal\hg_features\Controller\NodeAPIController->list() (Line: 450) Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock->__construct() (Line: 718) Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock::create() (Line: 21) Drupal\Core\Plugin\Factory\ContainerFactory->createInstance() (Line: 76) Drupal\Component\Plugin\PluginManagerBase->createInstance() (Line: 62) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->initializePlugin() (Line: 57) Drupal\block\BlockPluginCollection->initializePlugin() (Line: 80) Drupal\Component\Plugin\LazyPluginCollection->get() (Line: 45) Drupal\block\BlockPluginCollection->get() (Line: 88) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->setConfiguration() (Line: 104) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->addInstanceId() (Line: 55) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->__construct() (Line: 34) Drupal\block\BlockPluginCollection->__construct() (Line: 158) Drupal\block\Entity\Block->getPluginCollection() (Line: 147) Drupal\block\Entity\Block->getPlugin() (Line: 118) Drupal\block\BlockAccessControlHandler->checkAccess() (Line: 109) Drupal\Core\Entity\EntityAccessControlHandler->access() (Line: 329) Drupal\Core\Entity\EntityBase->access() (Line: 63) Drupal\block\BlockRepository->getVisibleBlocksPerRegion() (Line: 138) Drupal\block\Plugin\DisplayVariant\BlockPageVariant->build() (Line: 270) Drupal\Core\Render\MainContent\HtmlRenderer->prepare() (Line: 128) Drupal\Core\Render\MainContent\HtmlRenderer->renderResponse() (Line: 90) Drupal\Core\EventSubscriber\MainContentViewSubscriber->onViewRenderArray() call_user_func() (Line: 111) Drupal\Component\EventDispatcher\ContainerAwareEventDispatcher->dispatch() (Line: 186) Symfony\Component\HttpKernel\HttpKernel->handleRaw() (Line: 76) Symfony\Component\HttpKernel\HttpKernel->handle() (Line: 53) Drupal\Core\StackMiddleware\Session->handle() (Line: 48) Drupal\Core\StackMiddleware\KernelPreHandle->handle() (Line: 28) Drupal\Core\StackMiddleware\ContentLength->handle() (Line: 201) Drupal\page_cache\StackMiddleware\PageCache->fetch() (Line: 138) Drupal\page_cache\StackMiddleware\PageCache->lookup() (Line: 87) Drupal\page_cache\StackMiddleware\PageCache->handle() (Line: 48) Drupal\Core\StackMiddleware\ReverseProxyMiddleware->handle() (Line: 51) Drupal\Core\StackMiddleware\NegotiationMiddleware->handle() (Line: 36) Drupal\Core\StackMiddleware\AjaxPageState->handle() (Line: 51) Drupal\Core\StackMiddleware\StackedHttpKernel->handle() (Line: 741) Drupal\Core\DrupalKernel->handle() (Line: 19)

Warning: unserialize(): Error at offset 0 of 572 bytes in Drupal\hg_features\Controller\APIController->export() (line 527 of modules/custom/hg_features/src/Controller/APIController.php).

Drupal\hg_features\Controller\APIController->export() (Line: 249) Drupal\hg_features\Controller\ContentAPIController->export() (Line: 461) Drupal\hg_features\Controller\NodeAPIController->export() (Line: 916) Drupal\hg_features\Controller\NodeAPIController->list() (Line: 450) Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock->__construct() (Line: 718) Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock::create() (Line: 21) Drupal\Core\Plugin\Factory\ContainerFactory->createInstance() (Line: 76) Drupal\Component\Plugin\PluginManagerBase->createInstance() (Line: 62) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->initializePlugin() (Line: 57) Drupal\block\BlockPluginCollection->initializePlugin() (Line: 80) Drupal\Component\Plugin\LazyPluginCollection->get() (Line: 45) Drupal\block\BlockPluginCollection->get() (Line: 88) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->setConfiguration() (Line: 104) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->addInstanceId() (Line: 55) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->__construct() (Line: 34) Drupal\block\BlockPluginCollection->__construct() (Line: 158) Drupal\block\Entity\Block->getPluginCollection() (Line: 147) Drupal\block\Entity\Block->getPlugin() (Line: 118) Drupal\block\BlockAccessControlHandler->checkAccess() (Line: 109) Drupal\Core\Entity\EntityAccessControlHandler->access() (Line: 329) Drupal\Core\Entity\EntityBase->access() (Line: 63) Drupal\block\BlockRepository->getVisibleBlocksPerRegion() (Line: 138) Drupal\block\Plugin\DisplayVariant\BlockPageVariant->build() (Line: 270) Drupal\Core\Render\MainContent\HtmlRenderer->prepare() (Line: 128) Drupal\Core\Render\MainContent\HtmlRenderer->renderResponse() (Line: 90) Drupal\Core\EventSubscriber\MainContentViewSubscriber->onViewRenderArray() call_user_func() (Line: 111) Drupal\Component\EventDispatcher\ContainerAwareEventDispatcher->dispatch() (Line: 186) Symfony\Component\HttpKernel\HttpKernel->handleRaw() (Line: 76) Symfony\Component\HttpKernel\HttpKernel->handle() (Line: 53) Drupal\Core\StackMiddleware\Session->handle() (Line: 48) Drupal\Core\StackMiddleware\KernelPreHandle->handle() (Line: 28) Drupal\Core\StackMiddleware\ContentLength->handle() (Line: 201) Drupal\page_cache\StackMiddleware\PageCache->fetch() (Line: 138) Drupal\page_cache\StackMiddleware\PageCache->lookup() (Line: 87) Drupal\page_cache\StackMiddleware\PageCache->handle() (Line: 48) Drupal\Core\StackMiddleware\ReverseProxyMiddleware->handle() (Line: 51) Drupal\Core\StackMiddleware\NegotiationMiddleware->handle() (Line: 36) Drupal\Core\StackMiddleware\AjaxPageState->handle() (Line: 51) Drupal\Core\StackMiddleware\StackedHttpKernel->handle() (Line: 741) Drupal\Core\DrupalKernel->handle() (Line: 19)

Warning: unserialize(): Error at offset 0 of 274 bytes in Drupal\hg_features\Controller\APIController->export() (line 527 of modules/custom/hg_features/src/Controller/APIController.php).

Drupal\hg_features\Controller\APIController->export() (Line: 249) Drupal\hg_features\Controller\ContentAPIController->export() (Line: 461) Drupal\hg_features\Controller\NodeAPIController->export() (Line: 916) Drupal\hg_features\Controller\NodeAPIController->list() (Line: 450) Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock->__construct() (Line: 718) Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock::create() (Line: 21) Drupal\Core\Plugin\Factory\ContainerFactory->createInstance() (Line: 76) Drupal\Component\Plugin\PluginManagerBase->createInstance() (Line: 62) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->initializePlugin() (Line: 57) Drupal\block\BlockPluginCollection->initializePlugin() (Line: 80) Drupal\Component\Plugin\LazyPluginCollection->get() (Line: 45) Drupal\block\BlockPluginCollection->get() (Line: 88) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->setConfiguration() (Line: 104) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->addInstanceId() (Line: 55) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->__construct() (Line: 34) Drupal\block\BlockPluginCollection->__construct() (Line: 158) Drupal\block\Entity\Block->getPluginCollection() (Line: 147) Drupal\block\Entity\Block->getPlugin() (Line: 118) Drupal\block\BlockAccessControlHandler->checkAccess() (Line: 109) Drupal\Core\Entity\EntityAccessControlHandler->access() (Line: 329) Drupal\Core\Entity\EntityBase->access() (Line: 63) Drupal\block\BlockRepository->getVisibleBlocksPerRegion() (Line: 138) Drupal\block\Plugin\DisplayVariant\BlockPageVariant->build() (Line: 270) Drupal\Core\Render\MainContent\HtmlRenderer->prepare() (Line: 128) Drupal\Core\Render\MainContent\HtmlRenderer->renderResponse() (Line: 90) Drupal\Core\EventSubscriber\MainContentViewSubscriber->onViewRenderArray() call_user_func() (Line: 111) Drupal\Component\EventDispatcher\ContainerAwareEventDispatcher->dispatch() (Line: 186) Symfony\Component\HttpKernel\HttpKernel->handleRaw() (Line: 76) Symfony\Component\HttpKernel\HttpKernel->handle() (Line: 53) Drupal\Core\StackMiddleware\Session->handle() (Line: 48) Drupal\Core\StackMiddleware\KernelPreHandle->handle() (Line: 28) Drupal\Core\StackMiddleware\ContentLength->handle() (Line: 201) Drupal\page_cache\StackMiddleware\PageCache->fetch() (Line: 138) Drupal\page_cache\StackMiddleware\PageCache->lookup() (Line: 87) Drupal\page_cache\StackMiddleware\PageCache->handle() (Line: 48) Drupal\Core\StackMiddleware\ReverseProxyMiddleware->handle() (Line: 51) Drupal\Core\StackMiddleware\NegotiationMiddleware->handle() (Line: 36) Drupal\Core\StackMiddleware\AjaxPageState->handle() (Line: 51) Drupal\Core\StackMiddleware\StackedHttpKernel->handle() (Line: 741) Drupal\Core\DrupalKernel->handle() (Line: 19)

Warning: unserialize(): Error at offset 0 of 248 bytes in Drupal\hg_features\Controller\APIController->export() (line 527 of modules/custom/hg_features/src/Controller/APIController.php).

Drupal\hg_features\Controller\APIController->export() (Line: 249) Drupal\hg_features\Controller\ContentAPIController->export() (Line: 461) Drupal\hg_features\Controller\NodeAPIController->export() (Line: 916) Drupal\hg_features\Controller\NodeAPIController->list() (Line: 450) Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock->__construct() (Line: 718) Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock::create() (Line: 21) Drupal\Core\Plugin\Factory\ContainerFactory->createInstance() (Line: 76) Drupal\Component\Plugin\PluginManagerBase->createInstance() (Line: 62) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->initializePlugin() (Line: 57) Drupal\block\BlockPluginCollection->initializePlugin() (Line: 80) Drupal\Component\Plugin\LazyPluginCollection->get() (Line: 45) Drupal\block\BlockPluginCollection->get() (Line: 88) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->setConfiguration() (Line: 104) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->addInstanceId() (Line: 55) Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->__construct() (Line: 34) Drupal\block\BlockPluginCollection->__construct() (Line: 158) Drupal\block\Entity\Block->getPluginCollection() (Line: 147) Drupal\block\Entity\Block->getPlugin() (Line: 118) Drupal\block\BlockAccessControlHandler->checkAccess() (Line: 109) Drupal\Core\Entity\EntityAccessControlHandler->access() (Line: 329) Drupal\Core\Entity\EntityBase->access() (Line: 63) Drupal\block\BlockRepository->getVisibleBlocksPerRegion() (Line: 138) Drupal\block\Plugin\DisplayVariant\BlockPageVariant->build() (Line: 270) Drupal\Core\Render\MainContent\HtmlRenderer->prepare() (Line: 128) Drupal\Core\Render\MainContent\HtmlRenderer->renderResponse() (Line: 90) Drupal\Core\EventSubscriber\MainContentViewSubscriber->onViewRenderArray() call_user_func() (Line: 111) Drupal\Component\EventDispatcher\ContainerAwareEventDispatcher->dispatch() (Line: 186) Symfony\Component\HttpKernel\HttpKernel->handleRaw() (Line: 76) Symfony\Component\HttpKernel\HttpKernel->handle() (Line: 53) Drupal\Core\StackMiddleware\Session->handle() (Line: 48) Drupal\Core\StackMiddleware\KernelPreHandle->handle() (Line: 28) Drupal\Core\StackMiddleware\ContentLength->handle() (Line: 201) Drupal\page_cache\StackMiddleware\PageCache->fetch() (Line: 138) Drupal\page_cache\StackMiddleware\PageCache->lookup() (Line: 87) Drupal\page_cache\StackMiddleware\PageCache->handle() (Line: 48) Drupal\Core\StackMiddleware\ReverseProxyMiddleware->handle() (Line: 51) Drupal\Core\StackMiddleware\NegotiationMiddleware->handle() (Line: 36) Drupal\Core\StackMiddleware\AjaxPageState->handle() (Line: 51) Drupal\Core\StackMiddleware\StackedHttpKernel->handle() (Line: 741) Drupal\Core\DrupalKernel->handle() (Line: 19)

Warning: unserialize(): Error at offset 0 of 285 bytes in Drupal\hg_features\Controller\APIController->export() (line 527 of modules/custom/hg_features/src/Controller/APIController.php).

Drupal\hg_features\Controller\APIController->export() (Line: 249)

Drupal\hg_features\Controller\ContentAPIController->export() (Line: 461)

Drupal\hg_features\Controller\NodeAPIController->export() (Line: 916)

Drupal\hg_features\Controller\NodeAPIController->list() (Line: 450)

Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock->__construct() (Line: 718)

Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock::create() (Line: 21)

Drupal\Core\Plugin\Factory\ContainerFactory->createInstance() (Line: 76)

Drupal\Component\Plugin\PluginManagerBase->createInstance() (Line: 62)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->initializePlugin() (Line: 57)

Drupal\block\BlockPluginCollection->initializePlugin() (Line: 80)

Drupal\Component\Plugin\LazyPluginCollection->get() (Line: 45)

Drupal\block\BlockPluginCollection->get() (Line: 88)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->setConfiguration() (Line: 104)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->addInstanceId() (Line: 55)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->__construct() (Line: 34)

Drupal\block\BlockPluginCollection->__construct() (Line: 158)

Drupal\block\Entity\Block->getPluginCollection() (Line: 147)

Drupal\block\Entity\Block->getPlugin() (Line: 96)

Drupal\block\BlockViewBuilder::buildPreRenderableBlock() (Line: 158)

Drupal\block\BlockViewBuilder::lazyBuilder()

call_user_func_array() (Line: 113)

Drupal\Core\Render\Renderer->doTrustedCallback() (Line: 875)

Drupal\Core\Render\Renderer->doCallback() (Line: 411)

Drupal\Core\Render\Renderer->doRender() (Line: 504)

Drupal\Core\Render\Renderer->doRender() (Line: 248)

Drupal\Core\Render\Renderer->render() (Line: 484)

Drupal\Core\Template\TwigExtension->escapeFilter() (Line: 106)

__TwigTemplate_2b9f9278b9cf70190504a36e4c791768->doDisplay() (Line: 388)

Twig\Template->yield() (Line: 344)

Twig\Template->display() (Line: 359)

Twig\Template->render() (Line: 51)

Twig\TemplateWrapper->render() (Line: 33)

twig_render_template() (Line: 348)

Drupal\Core\Theme\ThemeManager->render() (Line: 491)

Drupal\Core\Render\Renderer->doRender() (Line: 248)

Drupal\Core\Render\Renderer->render() (Line: 484)

Drupal\Core\Template\TwigExtension->escapeFilter() (Line: 83)

__TwigTemplate_79ac63304157fde84dc591620a2a54aa->doDisplay() (Line: 388)

Twig\Template->yield() (Line: 344)

Twig\Template->display() (Line: 359)

Twig\Template->render() (Line: 51)

Twig\TemplateWrapper->render() (Line: 33)

twig_render_template() (Line: 348)

Drupal\Core\Theme\ThemeManager->render() (Line: 491)

Drupal\Core\Render\Renderer->doRender() (Line: 248)

Drupal\Core\Render\Renderer->render() (Line: 158)

Drupal\Core\Render\MainContent\HtmlRenderer->Drupal\Core\Render\MainContent\{closure}() (Line: 638)

Drupal\Core\Render\Renderer->executeInRenderContext() (Line: 153)

Drupal\Core\Render\MainContent\HtmlRenderer->renderResponse() (Line: 90)

Drupal\Core\EventSubscriber\MainContentViewSubscriber->onViewRenderArray()

call_user_func() (Line: 111)

Drupal\Component\EventDispatcher\ContainerAwareEventDispatcher->dispatch() (Line: 186)

Symfony\Component\HttpKernel\HttpKernel->handleRaw() (Line: 76)

Symfony\Component\HttpKernel\HttpKernel->handle() (Line: 53)

Drupal\Core\StackMiddleware\Session->handle() (Line: 48)

Drupal\Core\StackMiddleware\KernelPreHandle->handle() (Line: 28)

Drupal\Core\StackMiddleware\ContentLength->handle() (Line: 201)

Drupal\page_cache\StackMiddleware\PageCache->fetch() (Line: 138)

Drupal\page_cache\StackMiddleware\PageCache->lookup() (Line: 87)

Drupal\page_cache\StackMiddleware\PageCache->handle() (Line: 48)

Drupal\Core\StackMiddleware\ReverseProxyMiddleware->handle() (Line: 51)

Drupal\Core\StackMiddleware\NegotiationMiddleware->handle() (Line: 36)

Drupal\Core\StackMiddleware\AjaxPageState->handle() (Line: 51)

Drupal\Core\StackMiddleware\StackedHttpKernel->handle() (Line: 741)

Drupal\Core\DrupalKernel->handle() (Line: 19)

Warning: unserialize(): Error at offset 0 of 378 bytes in Drupal\hg_features\Controller\APIController->export() (line 527 of modules/custom/hg_features/src/Controller/APIController.php).

Drupal\hg_features\Controller\APIController->export() (Line: 249)

Drupal\hg_features\Controller\ContentAPIController->export() (Line: 461)

Drupal\hg_features\Controller\NodeAPIController->export() (Line: 916)

Drupal\hg_features\Controller\NodeAPIController->list() (Line: 450)

Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock->__construct() (Line: 718)

Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock::create() (Line: 21)

Drupal\Core\Plugin\Factory\ContainerFactory->createInstance() (Line: 76)

Drupal\Component\Plugin\PluginManagerBase->createInstance() (Line: 62)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->initializePlugin() (Line: 57)

Drupal\block\BlockPluginCollection->initializePlugin() (Line: 80)

Drupal\Component\Plugin\LazyPluginCollection->get() (Line: 45)

Drupal\block\BlockPluginCollection->get() (Line: 88)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->setConfiguration() (Line: 104)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->addInstanceId() (Line: 55)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->__construct() (Line: 34)

Drupal\block\BlockPluginCollection->__construct() (Line: 158)

Drupal\block\Entity\Block->getPluginCollection() (Line: 147)

Drupal\block\Entity\Block->getPlugin() (Line: 96)

Drupal\block\BlockViewBuilder::buildPreRenderableBlock() (Line: 158)

Drupal\block\BlockViewBuilder::lazyBuilder()

call_user_func_array() (Line: 113)

Drupal\Core\Render\Renderer->doTrustedCallback() (Line: 875)

Drupal\Core\Render\Renderer->doCallback() (Line: 411)

Drupal\Core\Render\Renderer->doRender() (Line: 504)

Drupal\Core\Render\Renderer->doRender() (Line: 248)

Drupal\Core\Render\Renderer->render() (Line: 484)

Drupal\Core\Template\TwigExtension->escapeFilter() (Line: 106)

__TwigTemplate_2b9f9278b9cf70190504a36e4c791768->doDisplay() (Line: 388)

Twig\Template->yield() (Line: 344)

Twig\Template->display() (Line: 359)

Twig\Template->render() (Line: 51)

Twig\TemplateWrapper->render() (Line: 33)

twig_render_template() (Line: 348)

Drupal\Core\Theme\ThemeManager->render() (Line: 491)

Drupal\Core\Render\Renderer->doRender() (Line: 248)

Drupal\Core\Render\Renderer->render() (Line: 484)

Drupal\Core\Template\TwigExtension->escapeFilter() (Line: 83)

__TwigTemplate_79ac63304157fde84dc591620a2a54aa->doDisplay() (Line: 388)

Twig\Template->yield() (Line: 344)

Twig\Template->display() (Line: 359)

Twig\Template->render() (Line: 51)

Twig\TemplateWrapper->render() (Line: 33)

twig_render_template() (Line: 348)

Drupal\Core\Theme\ThemeManager->render() (Line: 491)

Drupal\Core\Render\Renderer->doRender() (Line: 248)

Drupal\Core\Render\Renderer->render() (Line: 158)

Drupal\Core\Render\MainContent\HtmlRenderer->Drupal\Core\Render\MainContent\{closure}() (Line: 638)

Drupal\Core\Render\Renderer->executeInRenderContext() (Line: 153)

Drupal\Core\Render\MainContent\HtmlRenderer->renderResponse() (Line: 90)

Drupal\Core\EventSubscriber\MainContentViewSubscriber->onViewRenderArray()

call_user_func() (Line: 111)

Drupal\Component\EventDispatcher\ContainerAwareEventDispatcher->dispatch() (Line: 186)

Symfony\Component\HttpKernel\HttpKernel->handleRaw() (Line: 76)

Symfony\Component\HttpKernel\HttpKernel->handle() (Line: 53)

Drupal\Core\StackMiddleware\Session->handle() (Line: 48)

Drupal\Core\StackMiddleware\KernelPreHandle->handle() (Line: 28)

Drupal\Core\StackMiddleware\ContentLength->handle() (Line: 201)

Drupal\page_cache\StackMiddleware\PageCache->fetch() (Line: 138)

Drupal\page_cache\StackMiddleware\PageCache->lookup() (Line: 87)

Drupal\page_cache\StackMiddleware\PageCache->handle() (Line: 48)

Drupal\Core\StackMiddleware\ReverseProxyMiddleware->handle() (Line: 51)

Drupal\Core\StackMiddleware\NegotiationMiddleware->handle() (Line: 36)

Drupal\Core\StackMiddleware\AjaxPageState->handle() (Line: 51)

Drupal\Core\StackMiddleware\StackedHttpKernel->handle() (Line: 741)

Drupal\Core\DrupalKernel->handle() (Line: 19)

Warning: unserialize(): Error at offset 0 of 62 bytes in Drupal\hg_features\Controller\APIController->export() (line 527 of modules/custom/hg_features/src/Controller/APIController.php).

Drupal\hg_features\Controller\APIController->export() (Line: 249)

Drupal\hg_features\Controller\ContentAPIController->export() (Line: 461)

Drupal\hg_features\Controller\NodeAPIController->export() (Line: 403)

Drupal\hg_features\Controller\APIController->export() (Line: 249)

Drupal\hg_features\Controller\ContentAPIController->export() (Line: 461)

Drupal\hg_features\Controller\NodeAPIController->export() (Line: 422)

Drupal\hg_features\Controller\APIController->export() (Line: 249)

Drupal\hg_features\Controller\ContentAPIController->export() (Line: 461)

Drupal\hg_features\Controller\NodeAPIController->export() (Line: 916)

Drupal\hg_features\Controller\NodeAPIController->list() (Line: 450)

Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock->__construct() (Line: 718)

Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock::create() (Line: 21)

Drupal\Core\Plugin\Factory\ContainerFactory->createInstance() (Line: 76)

Drupal\Component\Plugin\PluginManagerBase->createInstance() (Line: 62)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->initializePlugin() (Line: 57)

Drupal\block\BlockPluginCollection->initializePlugin() (Line: 80)

Drupal\Component\Plugin\LazyPluginCollection->get() (Line: 45)

Drupal\block\BlockPluginCollection->get() (Line: 88)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->setConfiguration() (Line: 104)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->addInstanceId() (Line: 55)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->__construct() (Line: 34)

Drupal\block\BlockPluginCollection->__construct() (Line: 158)

Drupal\block\Entity\Block->getPluginCollection() (Line: 147)

Drupal\block\Entity\Block->getPlugin() (Line: 96)

Drupal\block\BlockViewBuilder::buildPreRenderableBlock() (Line: 158)

Drupal\block\BlockViewBuilder::lazyBuilder()

call_user_func_array() (Line: 113)

Drupal\Core\Render\Renderer->doTrustedCallback() (Line: 875)

Drupal\Core\Render\Renderer->doCallback() (Line: 411)

Drupal\Core\Render\Renderer->doRender() (Line: 504)

Drupal\Core\Render\Renderer->doRender() (Line: 248)

Drupal\Core\Render\Renderer->render() (Line: 484)

Drupal\Core\Template\TwigExtension->escapeFilter() (Line: 106)

__TwigTemplate_2b9f9278b9cf70190504a36e4c791768->doDisplay() (Line: 388)

Twig\Template->yield() (Line: 344)

Twig\Template->display() (Line: 359)

Twig\Template->render() (Line: 51)

Twig\TemplateWrapper->render() (Line: 33)

twig_render_template() (Line: 348)

Drupal\Core\Theme\ThemeManager->render() (Line: 491)

Drupal\Core\Render\Renderer->doRender() (Line: 248)

Drupal\Core\Render\Renderer->render() (Line: 484)

Drupal\Core\Template\TwigExtension->escapeFilter() (Line: 83)

__TwigTemplate_79ac63304157fde84dc591620a2a54aa->doDisplay() (Line: 388)

Twig\Template->yield() (Line: 344)

Twig\Template->display() (Line: 359)

Twig\Template->render() (Line: 51)

Twig\TemplateWrapper->render() (Line: 33)

twig_render_template() (Line: 348)

Drupal\Core\Theme\ThemeManager->render() (Line: 491)

Drupal\Core\Render\Renderer->doRender() (Line: 248)

Drupal\Core\Render\Renderer->render() (Line: 158)

Drupal\Core\Render\MainContent\HtmlRenderer->Drupal\Core\Render\MainContent\{closure}() (Line: 638)

Drupal\Core\Render\Renderer->executeInRenderContext() (Line: 153)

Drupal\Core\Render\MainContent\HtmlRenderer->renderResponse() (Line: 90)

Drupal\Core\EventSubscriber\MainContentViewSubscriber->onViewRenderArray()

call_user_func() (Line: 111)

Drupal\Component\EventDispatcher\ContainerAwareEventDispatcher->dispatch() (Line: 186)

Symfony\Component\HttpKernel\HttpKernel->handleRaw() (Line: 76)

Symfony\Component\HttpKernel\HttpKernel->handle() (Line: 53)

Drupal\Core\StackMiddleware\Session->handle() (Line: 48)

Drupal\Core\StackMiddleware\KernelPreHandle->handle() (Line: 28)

Drupal\Core\StackMiddleware\ContentLength->handle() (Line: 201)

Drupal\page_cache\StackMiddleware\PageCache->fetch() (Line: 138)

Drupal\page_cache\StackMiddleware\PageCache->lookup() (Line: 87)

Drupal\page_cache\StackMiddleware\PageCache->handle() (Line: 48)

Drupal\Core\StackMiddleware\ReverseProxyMiddleware->handle() (Line: 51)

Drupal\Core\StackMiddleware\NegotiationMiddleware->handle() (Line: 36)

Drupal\Core\StackMiddleware\AjaxPageState->handle() (Line: 51)

Drupal\Core\StackMiddleware\StackedHttpKernel->handle() (Line: 741)

Drupal\Core\DrupalKernel->handle() (Line: 19)

Warning: unserialize(): Error at offset 0 of 62 bytes in Drupal\hg_features\Controller\APIController->export() (line 527 of modules/custom/hg_features/src/Controller/APIController.php).

Drupal\hg_features\Controller\APIController->export() (Line: 249)

Drupal\hg_features\Controller\ContentAPIController->export() (Line: 461)

Drupal\hg_features\Controller\NodeAPIController->export() (Line: 403)

Drupal\hg_features\Controller\APIController->export() (Line: 249)

Drupal\hg_features\Controller\ContentAPIController->export() (Line: 461)

Drupal\hg_features\Controller\NodeAPIController->export() (Line: 916)

Drupal\hg_features\Controller\NodeAPIController->list() (Line: 450)

Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock->__construct() (Line: 718)

Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock::create() (Line: 21)

Drupal\Core\Plugin\Factory\ContainerFactory->createInstance() (Line: 76)

Drupal\Component\Plugin\PluginManagerBase->createInstance() (Line: 62)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->initializePlugin() (Line: 57)

Drupal\block\BlockPluginCollection->initializePlugin() (Line: 80)

Drupal\Component\Plugin\LazyPluginCollection->get() (Line: 45)

Drupal\block\BlockPluginCollection->get() (Line: 88)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->setConfiguration() (Line: 104)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->addInstanceId() (Line: 55)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->__construct() (Line: 34)

Drupal\block\BlockPluginCollection->__construct() (Line: 158)

Drupal\block\Entity\Block->getPluginCollection() (Line: 147)

Drupal\block\Entity\Block->getPlugin() (Line: 96)

Drupal\block\BlockViewBuilder::buildPreRenderableBlock() (Line: 158)

Drupal\block\BlockViewBuilder::lazyBuilder()

call_user_func_array() (Line: 113)

Drupal\Core\Render\Renderer->doTrustedCallback() (Line: 875)

Drupal\Core\Render\Renderer->doCallback() (Line: 411)

Drupal\Core\Render\Renderer->doRender() (Line: 504)

Drupal\Core\Render\Renderer->doRender() (Line: 248)

Drupal\Core\Render\Renderer->render() (Line: 484)

Drupal\Core\Template\TwigExtension->escapeFilter() (Line: 106)

__TwigTemplate_2b9f9278b9cf70190504a36e4c791768->doDisplay() (Line: 388)

Twig\Template->yield() (Line: 344)

Twig\Template->display() (Line: 359)

Twig\Template->render() (Line: 51)

Twig\TemplateWrapper->render() (Line: 33)

twig_render_template() (Line: 348)

Drupal\Core\Theme\ThemeManager->render() (Line: 491)

Drupal\Core\Render\Renderer->doRender() (Line: 248)

Drupal\Core\Render\Renderer->render() (Line: 484)

Drupal\Core\Template\TwigExtension->escapeFilter() (Line: 83)

__TwigTemplate_79ac63304157fde84dc591620a2a54aa->doDisplay() (Line: 388)

Twig\Template->yield() (Line: 344)

Twig\Template->display() (Line: 359)

Twig\Template->render() (Line: 51)

Twig\TemplateWrapper->render() (Line: 33)

twig_render_template() (Line: 348)

Drupal\Core\Theme\ThemeManager->render() (Line: 491)

Drupal\Core\Render\Renderer->doRender() (Line: 248)

Drupal\Core\Render\Renderer->render() (Line: 158)

Drupal\Core\Render\MainContent\HtmlRenderer->Drupal\Core\Render\MainContent\{closure}() (Line: 638)

Drupal\Core\Render\Renderer->executeInRenderContext() (Line: 153)

Drupal\Core\Render\MainContent\HtmlRenderer->renderResponse() (Line: 90)

Drupal\Core\EventSubscriber\MainContentViewSubscriber->onViewRenderArray()

call_user_func() (Line: 111)

Drupal\Component\EventDispatcher\ContainerAwareEventDispatcher->dispatch() (Line: 186)

Symfony\Component\HttpKernel\HttpKernel->handleRaw() (Line: 76)

Symfony\Component\HttpKernel\HttpKernel->handle() (Line: 53)

Drupal\Core\StackMiddleware\Session->handle() (Line: 48)

Drupal\Core\StackMiddleware\KernelPreHandle->handle() (Line: 28)

Drupal\Core\StackMiddleware\ContentLength->handle() (Line: 201)

Drupal\page_cache\StackMiddleware\PageCache->fetch() (Line: 138)

Drupal\page_cache\StackMiddleware\PageCache->lookup() (Line: 87)

Drupal\page_cache\StackMiddleware\PageCache->handle() (Line: 48)

Drupal\Core\StackMiddleware\ReverseProxyMiddleware->handle() (Line: 51)

Drupal\Core\StackMiddleware\NegotiationMiddleware->handle() (Line: 36)

Drupal\Core\StackMiddleware\AjaxPageState->handle() (Line: 51)

Drupal\Core\StackMiddleware\StackedHttpKernel->handle() (Line: 741)

Drupal\Core\DrupalKernel->handle() (Line: 19)

Warning: unserialize(): Error at offset 0 of 572 bytes in Drupal\hg_features\Controller\APIController->export() (line 527 of modules/custom/hg_features/src/Controller/APIController.php).

Drupal\hg_features\Controller\APIController->export() (Line: 249)

Drupal\hg_features\Controller\ContentAPIController->export() (Line: 461)

Drupal\hg_features\Controller\NodeAPIController->export() (Line: 916)

Drupal\hg_features\Controller\NodeAPIController->list() (Line: 450)

Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock->__construct() (Line: 718)

Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock::create() (Line: 21)

Drupal\Core\Plugin\Factory\ContainerFactory->createInstance() (Line: 76)

Drupal\Component\Plugin\PluginManagerBase->createInstance() (Line: 62)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->initializePlugin() (Line: 57)

Drupal\block\BlockPluginCollection->initializePlugin() (Line: 80)

Drupal\Component\Plugin\LazyPluginCollection->get() (Line: 45)

Drupal\block\BlockPluginCollection->get() (Line: 88)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->setConfiguration() (Line: 104)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->addInstanceId() (Line: 55)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->__construct() (Line: 34)

Drupal\block\BlockPluginCollection->__construct() (Line: 158)

Drupal\block\Entity\Block->getPluginCollection() (Line: 147)

Drupal\block\Entity\Block->getPlugin() (Line: 96)

Drupal\block\BlockViewBuilder::buildPreRenderableBlock() (Line: 158)

Drupal\block\BlockViewBuilder::lazyBuilder()

call_user_func_array() (Line: 113)

Drupal\Core\Render\Renderer->doTrustedCallback() (Line: 875)

Drupal\Core\Render\Renderer->doCallback() (Line: 411)

Drupal\Core\Render\Renderer->doRender() (Line: 504)

Drupal\Core\Render\Renderer->doRender() (Line: 248)

Drupal\Core\Render\Renderer->render() (Line: 484)

Drupal\Core\Template\TwigExtension->escapeFilter() (Line: 106)

__TwigTemplate_2b9f9278b9cf70190504a36e4c791768->doDisplay() (Line: 388)

Twig\Template->yield() (Line: 344)

Twig\Template->display() (Line: 359)

Twig\Template->render() (Line: 51)

Twig\TemplateWrapper->render() (Line: 33)

twig_render_template() (Line: 348)

Drupal\Core\Theme\ThemeManager->render() (Line: 491)

Drupal\Core\Render\Renderer->doRender() (Line: 248)

Drupal\Core\Render\Renderer->render() (Line: 484)

Drupal\Core\Template\TwigExtension->escapeFilter() (Line: 83)

__TwigTemplate_79ac63304157fde84dc591620a2a54aa->doDisplay() (Line: 388)

Twig\Template->yield() (Line: 344)

Twig\Template->display() (Line: 359)

Twig\Template->render() (Line: 51)

Twig\TemplateWrapper->render() (Line: 33)

twig_render_template() (Line: 348)

Drupal\Core\Theme\ThemeManager->render() (Line: 491)

Drupal\Core\Render\Renderer->doRender() (Line: 248)

Drupal\Core\Render\Renderer->render() (Line: 158)

Drupal\Core\Render\MainContent\HtmlRenderer->Drupal\Core\Render\MainContent\{closure}() (Line: 638)

Drupal\Core\Render\Renderer->executeInRenderContext() (Line: 153)

Drupal\Core\Render\MainContent\HtmlRenderer->renderResponse() (Line: 90)

Drupal\Core\EventSubscriber\MainContentViewSubscriber->onViewRenderArray()

call_user_func() (Line: 111)

Drupal\Component\EventDispatcher\ContainerAwareEventDispatcher->dispatch() (Line: 186)

Symfony\Component\HttpKernel\HttpKernel->handleRaw() (Line: 76)

Symfony\Component\HttpKernel\HttpKernel->handle() (Line: 53)

Drupal\Core\StackMiddleware\Session->handle() (Line: 48)

Drupal\Core\StackMiddleware\KernelPreHandle->handle() (Line: 28)

Drupal\Core\StackMiddleware\ContentLength->handle() (Line: 201)

Drupal\page_cache\StackMiddleware\PageCache->fetch() (Line: 138)

Drupal\page_cache\StackMiddleware\PageCache->lookup() (Line: 87)

Drupal\page_cache\StackMiddleware\PageCache->handle() (Line: 48)

Drupal\Core\StackMiddleware\ReverseProxyMiddleware->handle() (Line: 51)

Drupal\Core\StackMiddleware\NegotiationMiddleware->handle() (Line: 36)

Drupal\Core\StackMiddleware\AjaxPageState->handle() (Line: 51)

Drupal\Core\StackMiddleware\StackedHttpKernel->handle() (Line: 741)

Drupal\Core\DrupalKernel->handle() (Line: 19)

Warning: unserialize(): Error at offset 0 of 274 bytes in Drupal\hg_features\Controller\APIController->export() (line 527 of modules/custom/hg_features/src/Controller/APIController.php).

Drupal\hg_features\Controller\APIController->export() (Line: 249)

Drupal\hg_features\Controller\ContentAPIController->export() (Line: 461)

Drupal\hg_features\Controller\NodeAPIController->export() (Line: 916)

Drupal\hg_features\Controller\NodeAPIController->list() (Line: 450)

Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock->__construct() (Line: 718)

Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock::create() (Line: 21)

Drupal\Core\Plugin\Factory\ContainerFactory->createInstance() (Line: 76)

Drupal\Component\Plugin\PluginManagerBase->createInstance() (Line: 62)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->initializePlugin() (Line: 57)

Drupal\block\BlockPluginCollection->initializePlugin() (Line: 80)

Drupal\Component\Plugin\LazyPluginCollection->get() (Line: 45)

Drupal\block\BlockPluginCollection->get() (Line: 88)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->setConfiguration() (Line: 104)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->addInstanceId() (Line: 55)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->__construct() (Line: 34)

Drupal\block\BlockPluginCollection->__construct() (Line: 158)

Drupal\block\Entity\Block->getPluginCollection() (Line: 147)

Drupal\block\Entity\Block->getPlugin() (Line: 96)

Drupal\block\BlockViewBuilder::buildPreRenderableBlock() (Line: 158)

Drupal\block\BlockViewBuilder::lazyBuilder()

call_user_func_array() (Line: 113)

Drupal\Core\Render\Renderer->doTrustedCallback() (Line: 875)

Drupal\Core\Render\Renderer->doCallback() (Line: 411)

Drupal\Core\Render\Renderer->doRender() (Line: 504)

Drupal\Core\Render\Renderer->doRender() (Line: 248)

Drupal\Core\Render\Renderer->render() (Line: 484)

Drupal\Core\Template\TwigExtension->escapeFilter() (Line: 106)

__TwigTemplate_2b9f9278b9cf70190504a36e4c791768->doDisplay() (Line: 388)

Twig\Template->yield() (Line: 344)

Twig\Template->display() (Line: 359)

Twig\Template->render() (Line: 51)

Twig\TemplateWrapper->render() (Line: 33)

twig_render_template() (Line: 348)

Drupal\Core\Theme\ThemeManager->render() (Line: 491)

Drupal\Core\Render\Renderer->doRender() (Line: 248)

Drupal\Core\Render\Renderer->render() (Line: 484)

Drupal\Core\Template\TwigExtension->escapeFilter() (Line: 83)

__TwigTemplate_79ac63304157fde84dc591620a2a54aa->doDisplay() (Line: 388)

Twig\Template->yield() (Line: 344)

Twig\Template->display() (Line: 359)

Twig\Template->render() (Line: 51)

Twig\TemplateWrapper->render() (Line: 33)

twig_render_template() (Line: 348)

Drupal\Core\Theme\ThemeManager->render() (Line: 491)

Drupal\Core\Render\Renderer->doRender() (Line: 248)

Drupal\Core\Render\Renderer->render() (Line: 158)

Drupal\Core\Render\MainContent\HtmlRenderer->Drupal\Core\Render\MainContent\{closure}() (Line: 638)

Drupal\Core\Render\Renderer->executeInRenderContext() (Line: 153)

Drupal\Core\Render\MainContent\HtmlRenderer->renderResponse() (Line: 90)

Drupal\Core\EventSubscriber\MainContentViewSubscriber->onViewRenderArray()

call_user_func() (Line: 111)

Drupal\Component\EventDispatcher\ContainerAwareEventDispatcher->dispatch() (Line: 186)

Symfony\Component\HttpKernel\HttpKernel->handleRaw() (Line: 76)

Symfony\Component\HttpKernel\HttpKernel->handle() (Line: 53)

Drupal\Core\StackMiddleware\Session->handle() (Line: 48)

Drupal\Core\StackMiddleware\KernelPreHandle->handle() (Line: 28)

Drupal\Core\StackMiddleware\ContentLength->handle() (Line: 201)

Drupal\page_cache\StackMiddleware\PageCache->fetch() (Line: 138)

Drupal\page_cache\StackMiddleware\PageCache->lookup() (Line: 87)

Drupal\page_cache\StackMiddleware\PageCache->handle() (Line: 48)

Drupal\Core\StackMiddleware\ReverseProxyMiddleware->handle() (Line: 51)

Drupal\Core\StackMiddleware\NegotiationMiddleware->handle() (Line: 36)

Drupal\Core\StackMiddleware\AjaxPageState->handle() (Line: 51)

Drupal\Core\StackMiddleware\StackedHttpKernel->handle() (Line: 741)

Drupal\Core\DrupalKernel->handle() (Line: 19)

Warning: unserialize(): Error at offset 0 of 248 bytes in Drupal\hg_features\Controller\APIController->export() (line 527 of modules/custom/hg_features/src/Controller/APIController.php).

Drupal\hg_features\Controller\APIController->export() (Line: 249)

Drupal\hg_features\Controller\ContentAPIController->export() (Line: 461)

Drupal\hg_features\Controller\NodeAPIController->export() (Line: 916)

Drupal\hg_features\Controller\NodeAPIController->list() (Line: 450)

Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock->__construct() (Line: 718)

Drupal\hg_mercury_card\Plugin\Block\ContentFeedBlock::create() (Line: 21)

Drupal\Core\Plugin\Factory\ContainerFactory->createInstance() (Line: 76)

Drupal\Component\Plugin\PluginManagerBase->createInstance() (Line: 62)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->initializePlugin() (Line: 57)

Drupal\block\BlockPluginCollection->initializePlugin() (Line: 80)

Drupal\Component\Plugin\LazyPluginCollection->get() (Line: 45)

Drupal\block\BlockPluginCollection->get() (Line: 88)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->setConfiguration() (Line: 104)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->addInstanceId() (Line: 55)

Drupal\Core\Plugin\DefaultSingleLazyPluginCollection->__construct() (Line: 34)

Drupal\block\BlockPluginCollection->__construct() (Line: 158)

Drupal\block\Entity\Block->getPluginCollection() (Line: 147)

Drupal\block\Entity\Block->getPlugin() (Line: 96)

Drupal\block\BlockViewBuilder::buildPreRenderableBlock() (Line: 158)

Drupal\block\BlockViewBuilder::lazyBuilder()

call_user_func_array() (Line: 113)

Drupal\Core\Render\Renderer->doTrustedCallback() (Line: 875)

Drupal\Core\Render\Renderer->doCallback() (Line: 411)

Drupal\Core\Render\Renderer->doRender() (Line: 504)

Drupal\Core\Render\Renderer->doRender() (Line: 248)

Drupal\Core\Render\Renderer->render() (Line: 484)

Drupal\Core\Template\TwigExtension->escapeFilter() (Line: 106)

__TwigTemplate_2b9f9278b9cf70190504a36e4c791768->doDisplay() (Line: 388)

Twig\Template->yield() (Line: 344)

Twig\Template->display() (Line: 359)

Twig\Template->render() (Line: 51)

Twig\TemplateWrapper->render() (Line: 33)

twig_render_template() (Line: 348)

Drupal\Core\Theme\ThemeManager->render() (Line: 491)

Drupal\Core\Render\Renderer->doRender() (Line: 248)

Drupal\Core\Render\Renderer->render() (Line: 484)

Drupal\Core\Template\TwigExtension->escapeFilter() (Line: 83)

__TwigTemplate_79ac63304157fde84dc591620a2a54aa->doDisplay() (Line: 388)

Twig\Template->yield() (Line: 344)

Twig\Template->display() (Line: 359)

Twig\Template->render() (Line: 51)

Twig\TemplateWrapper->render() (Line: 33)

twig_render_template() (Line: 348)

Drupal\Core\Theme\ThemeManager->render() (Line: 491)

Drupal\Core\Render\Renderer->doRender() (Line: 248)

Drupal\Core\Render\Renderer->render() (Line: 158)

Drupal\Core\Render\MainContent\HtmlRenderer->Drupal\Core\Render\MainContent\{closure}() (Line: 638)

Drupal\Core\Render\Renderer->executeInRenderContext() (Line: 153)

Drupal\Core\Render\MainContent\HtmlRenderer->renderResponse() (Line: 90)

Drupal\Core\EventSubscriber\MainContentViewSubscriber->onViewRenderArray()

call_user_func() (Line: 111)

Drupal\Component\EventDispatcher\ContainerAwareEventDispatcher->dispatch() (Line: 186)

Symfony\Component\HttpKernel\HttpKernel->handleRaw() (Line: 76)

Symfony\Component\HttpKernel\HttpKernel->handle() (Line: 53)

Drupal\Core\StackMiddleware\Session->handle() (Line: 48)

Drupal\Core\StackMiddleware\KernelPreHandle->handle() (Line: 28)

Drupal\Core\StackMiddleware\ContentLength->handle() (Line: 201)

Drupal\page_cache\StackMiddleware\PageCache->fetch() (Line: 138)

Drupal\page_cache\StackMiddleware\PageCache->lookup() (Line: 87)

Drupal\page_cache\StackMiddleware\PageCache->handle() (Line: 48)

Drupal\Core\StackMiddleware\ReverseProxyMiddleware->handle() (Line: 51)

Drupal\Core\StackMiddleware\NegotiationMiddleware->handle() (Line: 36)

Drupal\Core\StackMiddleware\AjaxPageState->handle() (Line: 51)

Drupal\Core\StackMiddleware\StackedHttpKernel->handle() (Line: 741)

Drupal\Core\DrupalKernel->handle() (Line: 19)

IRA Rollover to Gift Annuity

September 5, 2023If you would like to increase your retirement income and leave an impactful gift to GBMC, then the charitable gift annuity is a worthwhile option to consider.

Do you own an IRA?

-

Would you like to give more to GBMC (or another charity) but need your retirement income?

- Have you considered a charitable gift annuity in the past but were not ready?

If you answered “yes” to these questions, the Secure 2.0 Act provides a once-in-a-lifetime effortless way to help GBMC – and yourself – using a tax-free distribution from your IRA.

In December of last year, Congress passed a series of retirement changes to make it easier for retirees to become philanthropists. As of January 1, 2023, retirees aged 70.5 or older can donate up to $50,000 from their IRAs to fund gift annuities. While charities have offered gift annuities for years, the donations could not be made directly from retirement accounts until now. This change creates an important opportunity for charities and donors alike.

What is a Charitable Gift Annuity?

A charitable gift annuity (CGA) is a contract between you and GBMC. In exchange for your donation, we agree to pay you a fixed income for your lifetime. Upon your death, the annuity ceases, and the remaining principal is used to further our mission.

How does the Charitable Gift Annuity Work?

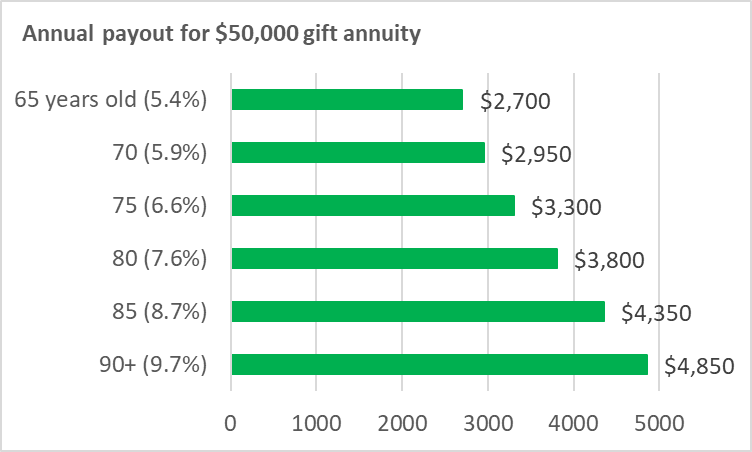

A charitable gift annuity (CGA) is a simple written agreement signed by you and a representative of GBMC. Once you contribute cash from your IRA – up to $50,000 per year – the CGA begins to make monthly or quarterly payments to you for your lifetime. The payment is based on your age to your nearest birthday. The IRA owner gets a minimum payout of 5% annually, taxed as ordinary income.

NOTE: Suggested maximum rates for single life. Source: American Council on Gift Annuities

Benefits of a Charitable Gift Annuity

- Lifetime income and financial security

- Attractive payment rates

- Opportunity to support GBMC

To learn more about this opportunity, or any planned giving vehicles, please contact: John Jeppi, Senior Director of Planned Giving at 443-849-3303 or jjeppi@gbmc.org

*Much of the content of this article is provided by Crescendo Interactive, Inc. 2023. Used with permission.